Technology, Media and Telecommunications

"Moving Forward Responsibly”, the Dutch DPA's vision on Generative AI

Today, the Dutch Data Protection Authority (Autoriteit Persoonsgegevens, or AP) has fired a regulatory shot across the bow of generative AI.

Het gebruik van AI in juridische procedures

AI wordt gezien als een grote kans voor de advocatuur. Tegelijk worstelen rechters met onzorgvuldig gebruik van AI bij het opstellen van processtukken. De vraag rijst of het gebruik van AI kan bijdragen aan het aannemen van misbruik van procesrecht.

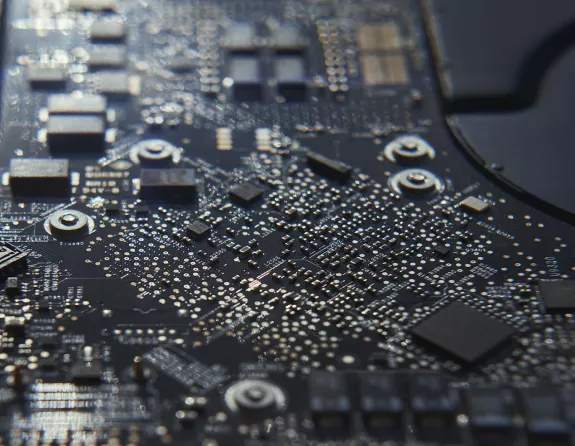

Cyber incidents… are you ready for it?

Cyber incidents have become an inescapable part of today’s reality, and they are here to stay. The question is no longer if your organisation will become affected by an incident, but when.

AI bij verzekeraars: DNB ziet groeiend gebruik, maar governance blijft achter

De Nederlandsche Bank (DNB) heeft op 21 januari 2026 de resultaten gepubliceerd van haar onderzoek naar het gebruik van Artificial Intelligence (AI) door verzekeraars. Deze publicatie is relevant omdat zij inzicht geeft in de huidige stand van AI-adoptie.

Stay current with our latest insights

Stibbeblog

Digital Law | BE & EU Law

On this blog, our Brussels TMT and Privacy and Data Protection team reports and provides context on Belgian and EU legal and regulatory developments in the field of digital law.