Civil-Law Notary

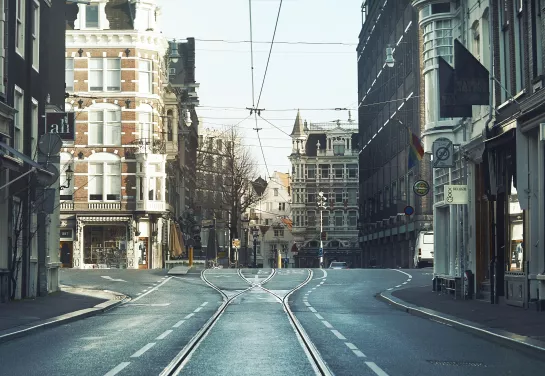

In our Amsterdam office, our civil-law notaries form an integral part of Stibbe's multi-disciplinary deal teams.

In large and complex M&A, capital markets, finance, real estate, restructuring and other transactions, our civil-law notaries create tailor-made solutions ensuring that implementation and completion are handled in a timely manner.

Services

In this context, we regularly advise both domestic and international clients and financial institutions on acquisitions and disposals, joint ventures, public and private takeovers, private equity, structuring and restructuring, reorganisations and finance, real estate, and security matters.

Our civil-law notaries also frequently advise listed and other large companies on the implementation of, and compliance with, corporate governance policies, as well as on stock exchange listings, protective measures, and annual or extraordinary shareholders meetings.

Over the years, we have initiated and designed new solutions that today are market practice. Now and in the future, we are committed to providing our clients with practical and efficient advice on all highly complex matters.

Publications & Insights

Special topics

Listed Companies Webtool

The Listed Companies Webtool (in Dutch) enables our listed corporate clients to not only prepare for and convene their general meetings quickly and easily, but also to find the answers themselves to all kinds of frequently recurring corporate questions.

This tool is a client only service.

UBO Webtool

Since the required information and the conditions to be a UBO differ from Member State to Member State, we have created this webtool. Our webtool not only contains all the latest developments about the UBO register, but also helps identify the UBO for your organisation and clarify what information must be registered with the UBO-register in the Member State your organisation is incorporated in. It provides in the possibility to identify the UBO for organisations incorporated in Belgium, Luxembourg and the Netherlands.

WBTR (Wet Bestuur en Toezicht Rechtspersonen)

This Webtool (in Dutch) provides our clients with information on the management and supervision of legal entities act, including parliamentary history and our e-book covering the transitional law and related topics.

Connect with our Civil-Law Notary practice

Manon Cremers