Hello new school year, hello new insolvency legislation: amendments to insolvency law enter into force today

Today the Law of 7 June 2023 transposing the Restructuring Directive ((EU) 2019/1023) enters into force which amends Book XX of the Code of Economic Law. Stibbe’s restructuring and insolvency specialist Pieter Wouters gives an overview of the possible restructuring and liquidation procedures and some important changes.

This year, September 1st is not only an exciting day for many schoolchildren, but also for all Belgian insolvency practitioners and companies in difficulty. Today the Act of 7 June 2023 transposing the EU Restructuring Directive (2019/1023)1 enters into force. This new law amends Book XX of the Code of Economic Law, and all insolvency proceedings that will be brought from today will be governed by the new rules.

Stibbe’s restructuring and insolvency specialist Pieter Wouters gives an overview of the possible restructuring and liquidation procedures and some important changes.

The different types of insolvency proceedings: same yet different

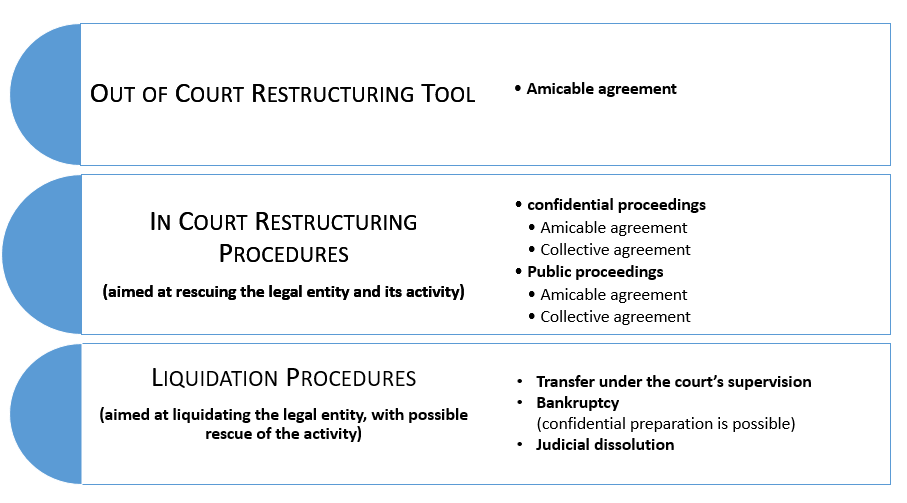

Besides the amicable agreement, which is the well-known out-of-court restructuring tool, judicial procedures from now on clearly distinguish between restructuring and liquidation proceedings. This means that restructuring proceedings in court intend to rescue the troubled legal entity and its business, whereas liquidation proceedings in court intend to wind up the legal entity with or without rescuing its business. This clear distinction between the two types of proceedings is a consequence of the Court of Justice of the EU’s ruling in the Plessers case. The qualification of a transfer under court supervision as a liquidation procedure should remove the uncertainty resulting from that case-law with regard to the takeover of employees.

The final objective of restructuring proceedings in court has remained the same, which is to reach an amicable agreement with certain creditors or to submit a collective agreement to all creditors. However, the new law allows the debtor in financial difficulty to choose how it wishes to achieve this outcome: whether through a public or confidential procedure. The latter procedure can also be triggered by other stakeholders. In case of a confidential procedure, the debtor in financial difficulty will not benefit from a moratorium, which is granted under a public procedure. Instead, it should seek the suspension of enforcement measures against specifically identified creditors. The confidential nature of the procedure should prevent any negative publicity about the debtor in question and thus increase the chances of success of the restructuring.

If bankruptcy is imminent, the debtor in financial difficulty can request that prior to being declared bankrupt, the transfer of all or part of its assets and activities is being prepared. The bankruptcy filing will then be kept confidential for 30 days (which can be extended by another 30 days). The purpose of this confidentiality is to preserve debtor’s value as a going concern as much as possible, which is often lost once declared bankrupt. In this regard, the debtor will have to demonstrate that the confidential preparation of the bankruptcy will lead to the generation of higher proceeds for the creditors and greater job retention. This procedure also aims to protect creditors and employees from unlawful transfers that the debtor in financial difficulty might have prepared silently without any judicial supervision.

Finally, judicial dissolution will also be an alternative to bankruptcy from now on if the debtor in financial difficulty has no major assets available and public interest demands such resolution.

Some new, important changes

Besides more ‘structural’ changes to insolvency proceedings, as mentioned above, the legislature introduced other changes as well. Some of the most important ones are briefly discussed below.

Amicable agreement with one creditor. Before today, if the debtor wishes to conclude an amicable agreement, it must do so with two or more creditors. But from now on, it can do so with only one creditor.

Moratorium of four months. The moratorium granted in public restructuring proceedings to the debtor has been reduced from six months to four months.

Distinction between SMEs and large enterprises in the context of a collective agreement. Voting on a collective agreement is now done differently depending on whether the debtor in financial difficulty is an SME or a large company. However, an SME can opt for the procedure that applies to large companies. Furthermore, an SME will be considered a large company if all of its affiliated companies, when combined, qualify the SME as a large enterprise. Whereas the rules did not change much for SMEs when it comes to reaching a collective agreement, they have changed significantly for large companies. In case of large companies, the plan will now be voted on according to the classes of creditors. If all classes agree, the court could ratify the plan, subject to limited review. If not all classes agree, the court can still ratify the plan under certain circumstances if the court concludes that doing so would benefit the creditors. In other words, the voting allows for a class cram-down and for a cross-class cram-down. If there are dissenting creditors within a class, the court will apply the “creditors’ best-interest” test. Ratification will take place if, through this test, no dissenting creditor is worse off under the plan than if the debtor were to become bankrupt. If there is a class of dissenting creditors, a cross-class cram-down is possible if, inter alia, and subject to exceptions, a majority and certain type of classes voted in favour of the plan and the ‘absolute priority rule’ has been complied with. This rule guarantees the order of priority of the payout that would apply if the debtor were to become liquidated. What is also new is shareholders’ greater level of involvement. For SMEs, the debt-to-equity swap will be maintained. For large companies, shareholder interests could be affected in the plan, and if so, the shareholders will also vote on the plan.

Additional powers for the Chamber for Companies in Difficulty. At a preventive level, the Chamber for Companies in Difficulty is conferred broader powers. Besides its ex officio investigations, they can facilitate settlements between debtors and creditors and appoint a restructuring expert whose assignment is to mediate.

Conclusion

Insolvency practitioners and companies in difficulty will experience the impact of these legislative changes in the coming years. They should be prepared because the European legislature is not sitting still when it comes to restructuring and insolvency. A new proposal for a directive on insolvency law is already in the pipeline.

For more information on these legislative changes, please see other articles by Pieter Wouters that will be published soon. We are already looking forward to what next school year will bring!

- 1Wet van 7 juni 2023 tot omzetting van Richtlijn (EU) 2019/1023 van het Europees Parlement en de Raad van 20 juni 2019 betreffende preventieve herstructureringsstelsels, betreffende kwijtschelding van schuld en beroepsverboden, en betreffende maatregelen ter verhoging van de efficiëntie van procedures inzake herstructurering, insolventie en kwijtschelding van schuld, en tot wijziging van Richtlijn(EU) 2017/1132 en houdende diverse bepalingen inzake insolvabiliteit / Loi transposant la directive 2019/1023 du Parlement européen et du Conseil du 20 juin 2019 relative aux cadres de restructuration préventive, à la remise de dettes et aux déchéances, et aux mesures à prendre pour augmenter l'efficacité des procédures en matière de restructuration, d'insolvabilité et de remise de dettes, et modifiant la directive (UE) 2017/1132 et portant des dispositions diverses en matière d'insolvabilité