Dutch Supreme Court clarifies rules on the moment of default by operation of law: can the default be deferred following actions of the creditor?

The Dutch Supreme Court rendered judgment on 12 April 2024 ECLI:NL:HR:2024:575, clarifying the moment at which a debtor is in default following non-performance. In its judgment, the Supreme Court overturned the judgments of the lower District Court and the Court of Appeal, by ruling that if a creditor must infer from the debtor's statements that the latter will fail in the performance of the obligation, the debtor is in default as of that moment, regardless of whether the creditor subsequently sends a notice of default granting the debtor an additional period in which to perform.

Default under Dutch law

Unless otherwise agreed, a debtor is in default under Dutch law during the period in which performance is outstanding after it has become due – except to the extent that the delay cannot be imputed to him or performance is permanently impossible – and the creditor has either sent a formal notice of default (Article 6:82 of the Dutch Civil Code (DCC)) or such notice of default is not required because:

(a) performance was linked to a specific date, which has not been met;

(b) the obligation to perform arises from a wrongful act (Article 6:162 DCC) or from compensation as a result of a contractual breach (Article 6:74 DCC) and the obligation is not performed immediately; or

(c) a creditor must infer from the debtor's statements that the latter will fail to perform the obligation,

(Article 6:83 preamble and under (a), (b) and (c) DCC).

What was going on in this specific case?

The discussion in this case is about the sale and purchase of a plot of land. The claimant (A) purchased a plot, consisting of two garages, an office, a pantry and three storage units, from the defendant (B). A and B had a different opinion on whether a warehouse, which was also located on the plot, was included in the sale. B rejected A's claim that the warehouse was included in the sale, and therefore refused to perform its contractual obligation to transfer the plot to A. Although the rules concerning default set out in Articles 6:82 and 6:83 DCC appear to be relatively clear, the moment of default cannot easily be determined in the absence of any case-specific facts.

The requirement for case-specific facts to determine the moment of default had already been acknowledged by the Dutch Supreme Court in its judgment of 11 October 2019, ECLI:NL:HR:2019:1581, quoting parliamentary history:

"(…) that this is not so much about setting rigid rules that a creditor, after consulting the law, will be able to apply to the letter in practice, but rather that these articles should provide the court with the opportunity, in cases where the parties have acted – as they usually do – without detailed knowledge of the law, to arrive at a reasonable solution based on what could reasonably be expected of that creditor in the circumstances."

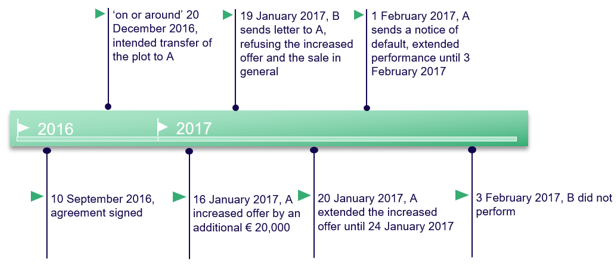

As for the facts of this case, we refer to the following timeline:

According to A, B was in default by operation of law on 19 January 2017 already, as that was the day on which A inferred from B’s statements that he would not cooperate in transferring the plot to A. The Court of Appeal however, argued differently and ruled that B's default did not start until 3 February 2017, after the additional period granted by A in which B could still perform expired without performance. The Court of Appeal found that by extending the offer and subsequently granting an additional performance period, A had not attached the consequences of a default by operation of law to B's statements of non-performance (ground 3.8 of the Court of Appeal’s judgment).

The Advocate-General stated in his conclusion that the Court of Appeal's ruling could be interpreted in two ways. Option 1 is that the Court of Appeal is of the opinion that the creditor must implicitly or explicitly invoke its statutory rights in order for the default by operation of law to start. This however, contradicts with the wording and rationale of Articles 6:81 and 6:83 DCC (preamble), as the creditor is in default (ipso jure) in the event of failure to provide a performance that is due and if any of the requirements of Article 6:83 DCC is met.

Requiring a specific (implicit or explicit) action from the creditor contravenes the rationale of the default by operation of law (grounds 3.4 and 3.5 of the Advocate-General’s conclusion).

Option 2 is that the Court of Appeal implicitly argued that the creditor waived its statutory rights following from a default by operation of law when A first extended the offer acceptance period and subsequently sent a formal notice of default in which he granted B additional time in which to perform. According to case law of the Dutch Supreme Court, a waiver of (statutory) rights must not be easily assumed1. The fact that a creditor still tries to find an amicable solution without initiating court proceedings can in itself not be considered a waiver of any such rights (ground 3.6 of the Advocate-General’s conclusion).

After rejecting both options, the Advocate-General sided with the claimant (A) and concluded that B had been in default by operation of law since 19 January 2017 (ground 3.12).

In its ruling, the Supreme Court also rejected the options identified by the Advocate-General. Default does not require that the creditor must notify the debtor that he invokes his statutory rights attached to the default (option 1), and the fact that a creditor allows the debtor in default to perform after all does not mean that the creditor has waived its rights in any way (option 2). If a creditor fails to perform in time and any of the requirements of Article 6:83 is met, the debtor is in default by operation of law, without any further action from the creditor being required (grounds 3.2 - 3.3).

What can we learn from this?

The Supreme Court's judgment is not innovative. This is evident from the reference by the Advocate-General and the Supreme Court to case law dating back to 1921. This case does show, however, how important it is, when the other party fails to live up to the agreements made, to identify the exact trigger for default because that determines when the default and hence the obligation to pay damages and statutory interest commences.

In practice, even once default has occurred, there may still be reason to give the other party another opportunity by setting an additional deadline. This Supreme Court judgment clarifies that, in principle, such a new chance does not affect the default that has already occurred. The fact that both the District Court and the Court of Appeal ruled differently on this point demonstrates that it is wise – if a new opportunity is granted – to make it crystal clear in the notice that the existing default and any resulting claims for damages against the debtor remain unaffected, to avoid the impression that the creditor waives its existing claims in any way.

1 HR 6 May 1921, ECLI:NL:1921:83, NJ 1921, p. 796, HR 11 February 2000, ECLI:NL:HR:2000:AA4777, and HR 7 December 2018, ECLI:NL:HR:2018:2255.