Dutch conditional withholding tax on dividends

A legislative proposal regarding a conditional withholding tax on dividends (if adopted: effective as of 1 January 2024) (Wetsvoorstel bronbelasting dividenden) was submitted to Dutch parliament on Thursday 25 March 2021.

Similar to the conditional withholding tax on interest and royalty payments (which applies since 1 January 2021; see our prior Tax Alert), the conditional withholding tax on dividends in principle only applies in respect of payments fulfilling certain conditions, i.e. payments to related entities that are located in low-taxed jurisdictions (hence the term ‘conditional’ withholding tax). ‘Related’ in this context means that the recipient should – alone or as a part of group working together – have a ’controlling interest’ in the distributing entity, e.g. if it has more than 50% of the voting rights. ‘Low-taxed jurisdictions’ are jurisdictions with a statutory profit tax of less than 9% and jurisdictions on the EU-list of non-cooperative jurisdictions. In addition – again in line with the conditional withholding tax on interest and royalty payments – the conditional dividend withholding tax also applies (1) in abusive situations (e.g. an indirect payment to a low-taxed jurisdiction via a conduit company) and (2) in respect of payments to hybrid entities. The conditional withholding tax will also be applicable to so-called non-holding cooperatives.

The conditional withholding tax proposal in principle follows the tax base of the ‘regular’ dividend withholding tax act (Wet op de dividendbelasting). The conditional withholding tax on dividends will be levied at a rate equal to the Dutch corporate income tax rate applicable to the highest bracket (currently 25%). According to the proposal the conditional dividend withholding tax may be levied in addition to the regular dividend withholding tax (“DWT”) of 15%; the proposal however contains an anti-cumulation rule (see also further below).

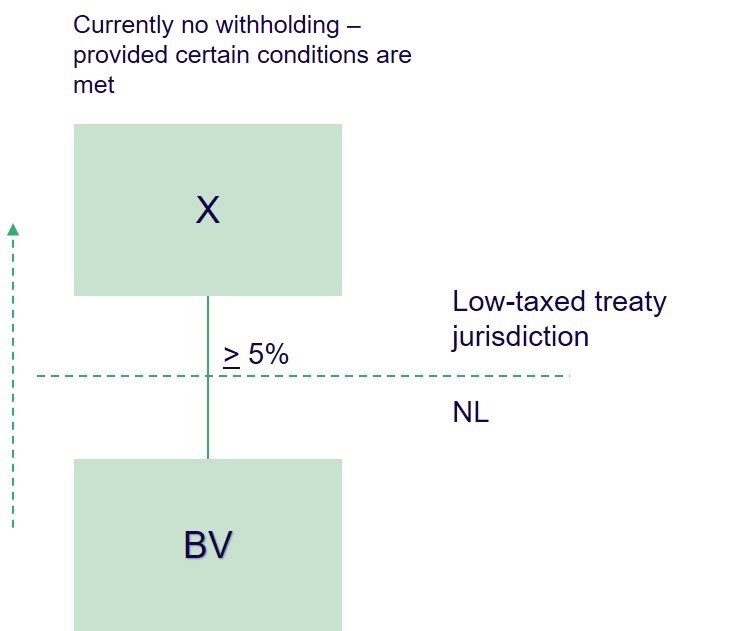

Intragroup dividend distributions to low-taxed tax treaty jurisdictions: current situation

Currently, intragroup dividend distributions to an entity resident in a low-taxed jurisdiction which has a qualifying tax treaty with the Netherlands in place may not be in scope of DWT because a domestic withholding exemption may apply, provided certain conditions are met (such as a minimum stake of 5% or more).

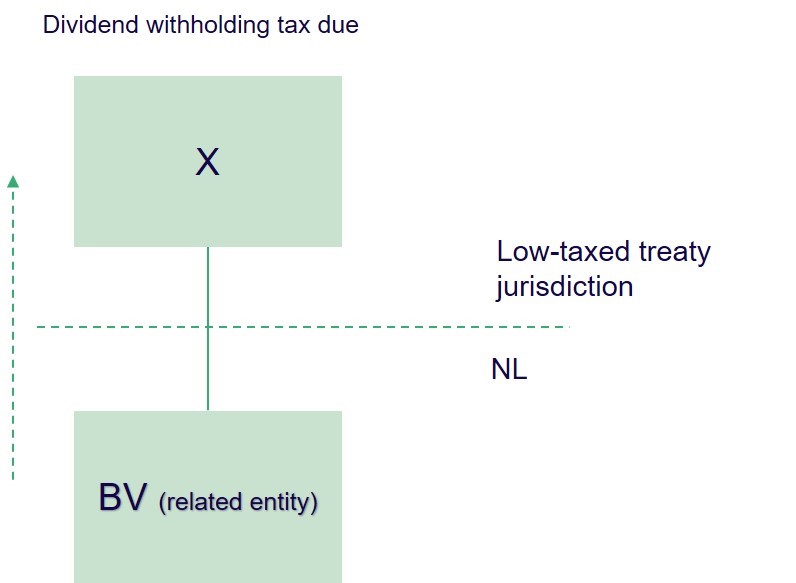

Intragroup dividend distributions to low-taxed (tax treaty) jurisdictions: treatment under submitted proposal

Under the proposal, dividend distributions to entities located in a low-taxed jurisdiction and which have a controlling interest (see above) in the distributing entity become subject to a conditional withholding tax at a rate of 25%. The distributing Dutch entity would then have to withhold this tax on the distribution and subsequently report and pay the withheld taxes within a month after end of the respective calendar year.

Anti-cumulation with ‘regular’ dividend withholding tax

In certain situations, the conditional withholding tax as well as the ‘regular’ DWT may be due on the same distribution. In that case, a cumulation of withholding taxes may occur (i.e. conditional withholding tax and DWT). The legislative proposal contains an anti-cumulation rule based on which the ‘regular’ withholding tax may be set off against the conditional withholding tax , as a result of which the distribution is taxed at the rate of the conditional withholding tax on dividends.

Such a cumulation may occur in respect of dividend distributions to low-taxed jurisdictions, that have not entered into a tax treaty with the Netherlands, as in such case the conditions to apply the domestic withholding exemption are not expected to be met.

Impact on treaties with low-taxed jurisdictions

Currently there may be a tax treaty in place between the Netherlands and the low-taxed jurisdiction. The Netherlands, however, aims to renegotiate these tax treaties to effectuate the conditional withholding tax. Tax treaty jurisdictions that already qualify as ‘low-taxed’ per 1 January 2021 are expected to be in scope of the conditional withholding tax per 1 January 2024. A transitional period of three years will apply to tax treaty jurisdictions that will be designated as ‘low-taxed’ on or after 1 January 2022.

Stibbe contributes Dutch chapter to Chambers Global Practice Guides Corporate Tax 2021

Lastly, we are proud to share with you the Dutch chapter of the Chambers Global Practice Guides Corporate Tax 2021, that was written by Michael Molenaars, Jeroen Smits, Reinout de Boer and Rogier van der Struijk. Besides providing you with an outline of Dutch corporate income taxation, the chapter pays attention to the impact of BEPS on the Dutch corporate income tax landscape.